In recent years, more investors have turned to ethical investing to align their financial goals with their values. One key tool in this approach is the ESG index, which measures a company’s performance based on environmental, social, and governance factors. As people become more aware of climate change and corporate responsibility, ethical investing is becoming an important way to support positive change while seeking financial returns.

What Is Ethical Investing?

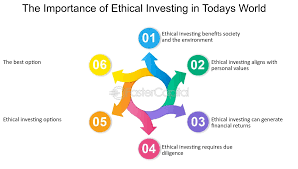

Ethical investing involves choosing investments that align with an individual’s moral or social principles. It is a method where investors actively seek out companies that positively impact society and the environment. Investors evaluate businesses based on how they treat their employees, their practices’ sustainability, and their leadership’s integrity. The goal is to avoid companies in harmful industries and find those that contribute positively to global well-being. Many investors now look at sustainability ratings or social responsibility scores to guide their decisions.

Why Ethical Investing Is Growing

The popularity of ethical investing is rising for various reasons. Increased awareness about global issues, such as climate change and income inequality, has driven many people to reconsider where their money is going. Younger generations, in particular, are leading this shift by demanding that companies act responsibly toward the planet and society. Many investors now feel that their financial decisions can make a real difference, encouraging businesses to adopt more sustainable practices. This movement is helping reshape how people think about investing.

The Importance of Environmental, Social, and Governance (ESG) Factors

Environmental, social, and governance factors are crucial in evaluating a company’s ethical standing. These factors allow investors to see how companies manage their environmental impact, treat workers, and maintain transparent leadership. Many firms are now graded on their efforts in these areas, providing clear indicators for responsible investors. Tools that assess these practices are becoming increasingly popular, helping individuals make more informed decisions about where to place their investments.

Benefits of Ethical Investing

For many, ethical investing offers more than just financial returns—it provides a sense of purpose. By supporting companies aligning with their values, investors can feel they are contributing to a larger cause. In addition to this personal satisfaction, environmentally or socially responsible businesses often have stronger long-term potential. Companies that embrace sustainability and ethical leadership tend to avoid controversies that can harm their reputation, making them potentially safer options for investors seeking stability.

Challenges of Ethical Investing

While ethical investing is appealing, it’s not without its challenges. One significant issue is ensuring that a company’s claims about being socially or environmentally responsible are legitimate. Some companies engage in “greenwashing,” where they exaggerate their commitment to sustainability for public relations purposes. Investors must carefully research these businesses to avoid falling for misleading information.

Furthermore, ethical investing might narrow the options for building a diversified portfolio, as certain industries or companies may be excluded based on personal values. Despite these hurdles, tools that evaluate company ethics continue to evolve, offering better guidance to those seeking responsible investment options.

Consulting the expertise of professionals is a solid piece of advice when diving into the world of ethical investing. Because there’s a lot of investment possibilities, you’ll want to do careful research beforehand.

SoFi says, “Exploring and incorporating sustainable strategies in your portfolio can be easy when you open an online brokerage account with SoFi Invest. The app allows you to buy and sell shares of stocks, ETFs, fractional shares, IPO shares, and more. Even better, SoFi members have complimentary access to advice from professionals, who can answer any questions you may have.”

Ethical investing has seen significant growth as individuals seek to use their financial power for positive change. Investors can ensure that their investments support businesses working toward a better future by focusing on environmental, social, and governance factors. Though challenges exist, such as verifying company practices and maintaining a balanced portfolio, the increasing use of sustainability ratings helps investors make smarter, more ethical choices. Ethical investing is not only about profit but also about investing in a better world for all people.